Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the banking system

Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the banking systemWe all know about Switzerland's banking secrecy, but a little less about its origins. One might think that it originates in a text of law, like in other banking centers

« It is not the federal banking laws' article 47 that defines the notion of banking secrecy in Switzerland, but common law; banking secrecy thus falls under the general dispositions of the code of contractual obligations, as well as under articles 27 and 28 of the civil code, which put into law the principle of identity protection. » (1) « Penalties for breaking this principle are covered by the federal banking laws' article 47, constituting a disposition of administrative penal law. »(2) The civil code protects every personal right worth protecting and, notably, private life secrecy. The Swiss federal Court estimates that, « the inviolability of private life does not only constitute a moral principle, but is also a civil right, a « judicial asset »; it is an attribute of personality, and the law protects it. »(3) And privacy in the economic sphere is also protected.

« What sane man would not put away some money in swiss banks ? Switzerland is the vault of the world », Félix Houphouët-Boigny, former President of the Ivory Coast.

? Switzerland is the vault of the world », Félix Houphouët-Boigny, former President of the Ivory Coast.

For a long time Switzerland has been building infrastructures to safeguard financialDuring the crisis of the London Gold Pool in the ‘70s, Zurich has even come close to becoming the main gold trading hub, at the expense of London. The Bank for International Settlements (BIS), the central banks' banker, is still based in Basel. Almost all of central banks' gold trades are effected by the BIS in the utmost discretion. The headquarters of the World Gold Council was in Zurich, before moving to London recently. Geneva, where the most important jewelry auctions take place, has also been the global center for jewelry and watchmaking for many years.

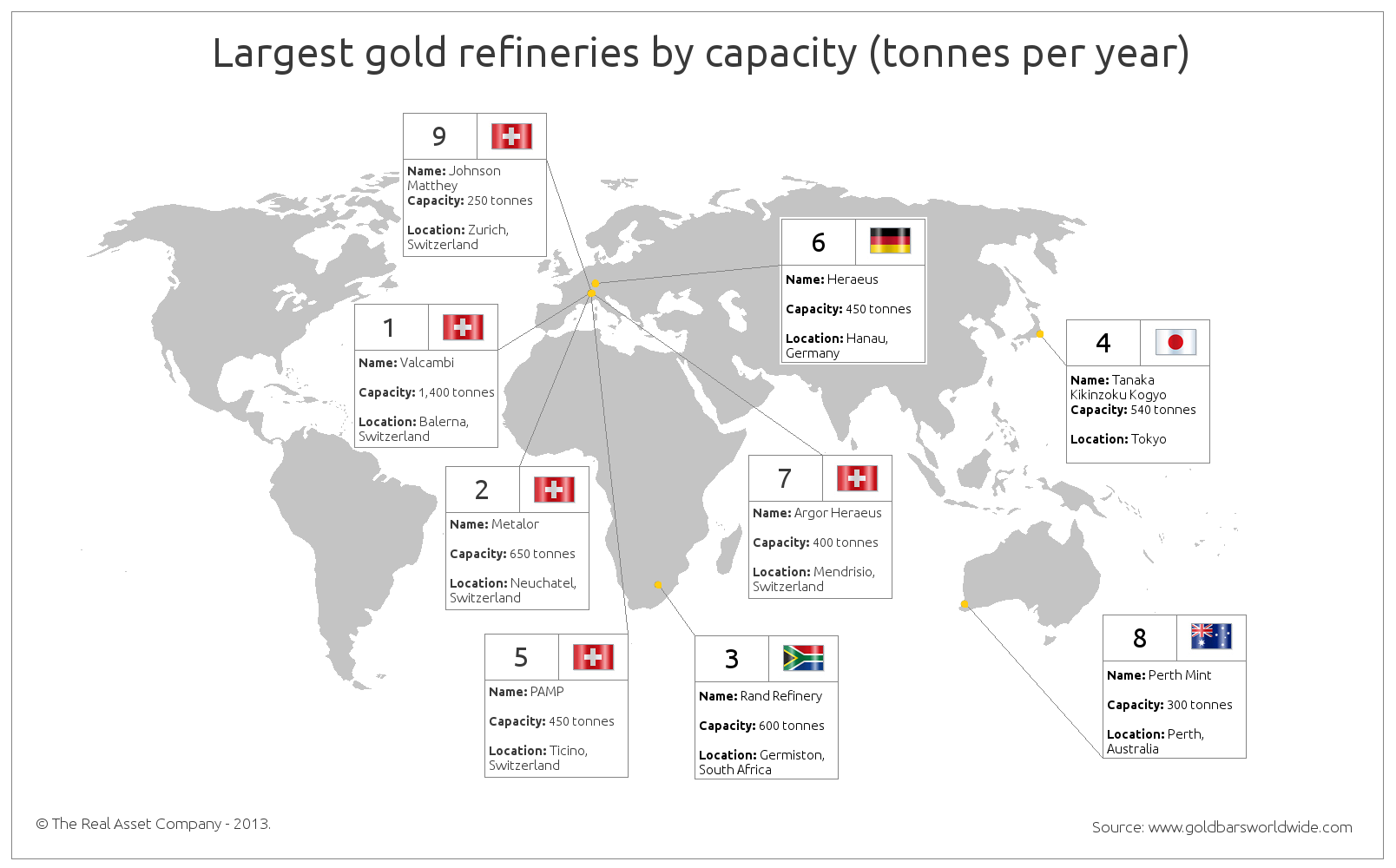

The Swiss have a reputation for excellence in gold refining. That has let Switzerland become the hub of gold refining, with nearly 70% of the world's gold transiting through the country. Mining companies and gold recyclers export to Switzerland, where the gold is purified to the highest levels (.9999 or even .99999). It is then exported in the whole world to jewellers, investors or central banks.

The best precious metals storage and safekeeping companies are also based in Switzerland.

Other countries are trying to compete with Switzerland, but they still have a long way to go, especially since Switzerland is not sleeping on its laurels. Two of those countries are City-States like Dubai and Singapore. Singapore is a stable haven in Asia, as is Dubai in the Middle East, but they haven't reached Switzerland's level yet. Dubai is trying to develop an expertise in refining and trading gold, whereas Singapore, already with an excellent infrastructure for wealth management, is developing its capacity for gold storage and, also, a gold trading market for Asia.

We live in uncertain times, and no one is safe from unforeseen events. In the actual context, it seems to me that Switzerland is the best place to store gold. However good the infrastructures may be, one must never lose sight of the financial health of the country in which one wants to store gold. A fiscal or financial paradise that has gone into debt

« It is said that the Swiss only love money... this is not true. They also love gold. » Anonymous

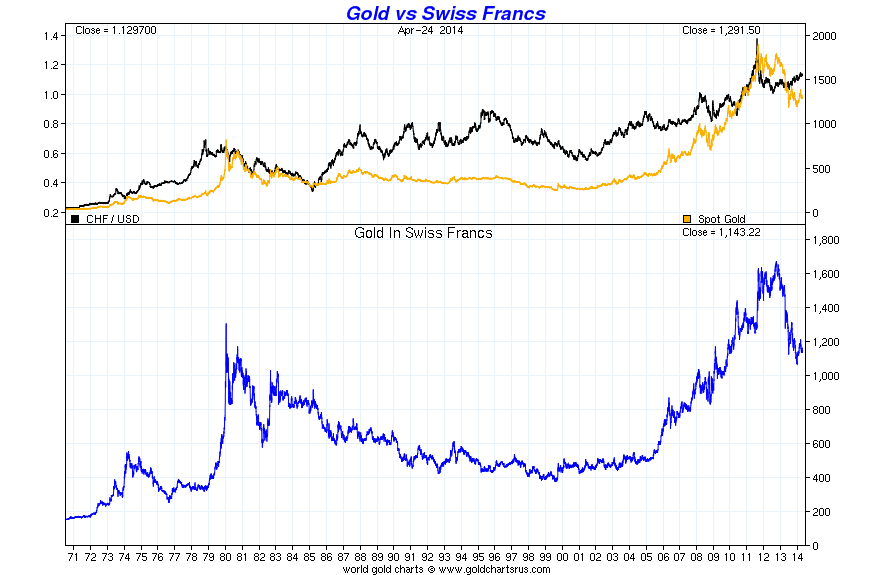

Gold Price vs Swiss franc Largest Gold Refineries by Capacity (tonnes per year)

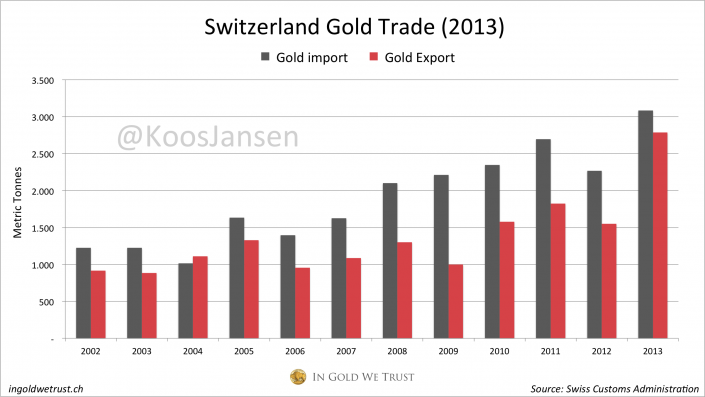

Largest Gold Refineries by Capacity (tonnes per year) Switzerland's Gold Trading (2013)

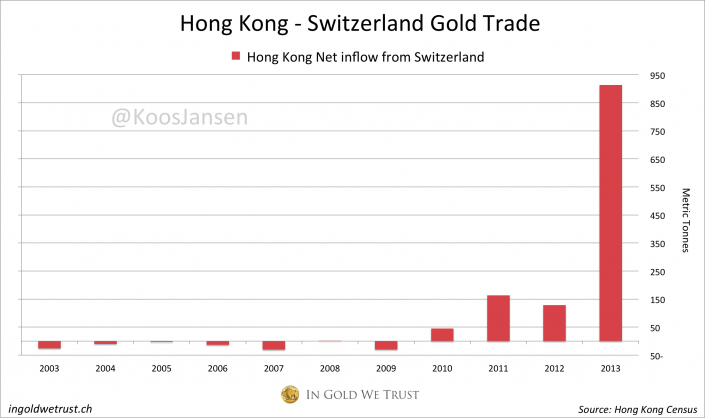

Switzerland's Gold Trading (2013) Gold Trading between Hong Kong and Switzerland

Gold Trading between Hong Kong and Switzerland Notes :

Notes :(1) (2) (3) Maurice Aubert, Jean-Philippe Kernen, Herbert Schonle, Le secret bancaire

Dan Popescu Gold & Silver Analyst / Member of the Goldbroker.com Editorial Team

Mr. Popescu is an independent investment analyst and studies the gold and silver market and their future role in the international monetary system. He has followed regularly since 1970 the gold, silver and foreign exchange markets. He has a bachelor degree in physics (1993) from Concordia University in Montreal, Canada and has completed the Canadian investment management certificate (1999) of the CSI. He is a member and was the president in 2004 of the CSTA and also was president in 2005 of the Montreal CFA Society. He is a member of the CFA Institute, the MTA, NYSSA, UKSIP, the CSTA and the Gold Standard Institute International.

Sources: https://www.goldbroker.com/en/news/switzerland-role-gold-market-483

Switzerland: the world's gold hub http://www.swissinfo.ch/eng/business/Switzerland:_the_world_s_gold_hub.html?cid=33706126

Edouard Chambost, Guide de la banque

Maurice Aubert, Jean-Philippe Kernen, Herbert Schonle, Le secret bancaire suisse

Nick Laird, www.sharelynx.com

Koos Jansen, www.ingoldwetrust.ch

Jan Skoyles, Where are the world's largest gold refineries?, http://therealasset.co.uk/gold-refinery-list/

No comments:

Post a Comment