FINANCIAL HIGHLIGHTS OF Q1, 2014, Compared to Q1, 2013:

- Cash flow from operations (1) decreased 25% to $6.6 million ($0.06 per share).

- Cash operating cost per silver equivalent ounce sold (2) decreased 7% to $7.14.

- All-in sustaining cash cost per silver equivalent ounce sold (2) decreased 40% to $9.71.

- Revenues reported decreased 15% to $13.0 million.

- Metal sales of 198,800 ounces of silver and 7,650 ounces of gold increased 27% and 4% respectively.

- Realized spot metal prices declined from $30 to $21 (30%) for silver and from $1,626 to $1,319 (19%) for gold.

- Net earnings were $2.5 million ($0.02 per share), compared to $6.0 million ($0.06 per share).

- Cash and cash equivalents were $54.5 million (at March 31, 2014), compared to $41.1 million (at March 31, 2013).

- Working capital was $63.7 million (at March 31, 2014), compared to $48.9 million (at March 31, 2013).

- Bullion inventory at March 31, 2014, included 59,114 ounces of silver and 2,084 ounces of gold.

Net earnings were $2,467,989 ($0.02 per share basic) for the first quarter compared with $6,002,276 ($0.06 per share basic) in 2013. The decrease in net earnings during the first quarter was primarily attributed by lower revenues resulting from significantly lower realized prices.

Silver and gold revenue totalled $13,005,527 (2013 - $15,329,642) in the first quarter. Silver sales totalled 198,800 ounces (2013 - 157,088), 27% higher than the same period in 2013. The foregoing, combined with a 30% lower average realized price at $21 (2013 - $30) per ounce, resulted in 12% less silver revenue. Total gold revenue reported in the first quarter decreased 16% compared to the same period in 2013. Total gold sales were 7,650 ounces (2013 - 7,370) or 4% above 2013. The Company

Cost of sales amounted to $4,686,523 (2013 - $4,368,519). Operating cash cost per silver equivalent ounce sold amounted to $7.14, Ag:Au 60.0:1 (2013 - $7.69, Ag:Au 55.8:1). The decrease in operating cash cost per silver equivalent ounce sold is driven generally by the difference in silver equivalence ratios. The 40% decrease in all-in sustaining cash costs from Q1 2013, is primarily due to lower exploration costs incurred by the Company during Q1 2014.

General and administrative expenses increased by 10% to $1,477,002 (2013 - $1,340,926) primarily due to an increase in regulatory expenses resulting from the onetime TSX listing fee.

(2) These are Non-IFRS performance measures. Refer to "CAUTIONARY NOTE REGARDING NON-IFRS PERFORMANCE MEASURES". Silver equivalent ("AgEq") ounces consist of the number of ounces of silver production/sold plus the number of ounces of gold production/sold multiplied by a 60:1 gold price to silver price ratio. Prior to Q1 2014, the AgEq ratio was based on the spot gold price to the spot silver price at the quarter end dates for financial reporting. All numbers are rounded.

OUTLOOK

SilverCrest's immediate focus is to (i) continue its efficient operation of its flagship Santa Elena low cost silver and gold mine, (ii) complete commissioning of the new 3,000 tonne per day CCD-MC processing plant, (iii) complete accelerated development of the underground mine for initial underground production, (iv) expand resources and subsequent reserves at Santa Elena by systematic exploration of the deposit, (v) evaluate and acquire exploration properties

CONFERENCE CALL

A conference call to discuss the results will be held on Thursday, May 15th. The call will be held at 10am PDT (1pm EDT). To participate in the conference call, please dial the following:

Participant Dial In Number(s)

Local / International: 416-849-5572

North American Toll-Free: 1-866-809-6768

A replay of the conference call will be archived for later playback on the Company's website at www.silvercrestmines.com.

SilverCrest Mines Inc. (NYSE MKT: SVLC; TSX: SVL) is a Canadian precious metals producer headquartered in Vancouver, BC. SilverCrest’s flagship property

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation and the United States Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation: risks related to precious and base metal price fluctuations; risks related to fluctuations in the currency markets (particularly the Mexican peso, Canadian dollar and United States dollar); risks related to the inherently dangerous activity of mining, including conditions or events beyond our control, and operating or technical difficulties in mineral exploration, development and mining activities; uncertainty in the Company's ability to raise financing and fund the exploration and development of its mineral properties; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that development activities will result in profitable mining operations; risks related to reserves and mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated and to diminishing quantities or grades of mineral reserves as properties are mined; risks related to governmental regulations and obtaining necessary licenses and permits; risks related to the business being subject to environmental laws and regulations which may increase costs of doing business and restrict our operations; risks related to mineral properties being subject to prior unregistered agreements, transfers, or claims and other defects in title; risks relating to inadequate insurance or inability to obtain insurance; risks related to potential litigation; risks related to the global economy; risks related to the Company's status as a foreign private issuer in the United States; risks related to all of the Company's properties being located in Mexico and El Salvador, including political, economic, social and regulatory instability; and risks related to officers and directors becoming associated with other natural resource companies which may give rise to conflicts of interests. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

N. Eric Fier, President & COO

SILVERCREST MINES INC.

Neither TSX Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact:

Fred Cooper

Telephone: (604) 694-1730 ext. 108

Toll Free: 1-866-691-1730

Email: info@silvercrestmines.com

Website: www.silvercrestmines.com

Address: Suite 501 - 570 Granville Street

Vancouver, BC Canada V6C 3P1

Published at Investorideas.com Newswire

Disclaimer / Disclosure : The Investorideas.com is a third party publisher of news and research Our sites do not make recommendations, but offer information portals to research news, articles, stock

BC Residents and Investor

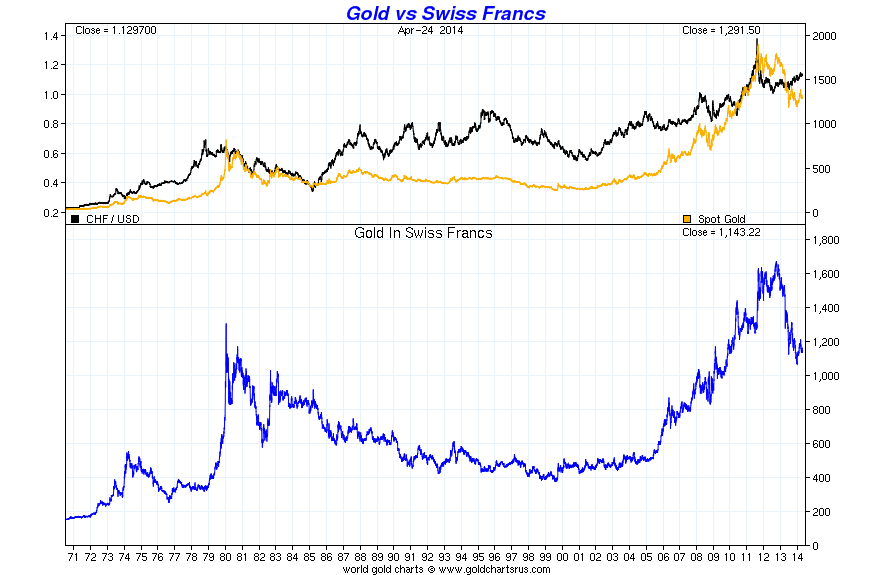

Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the

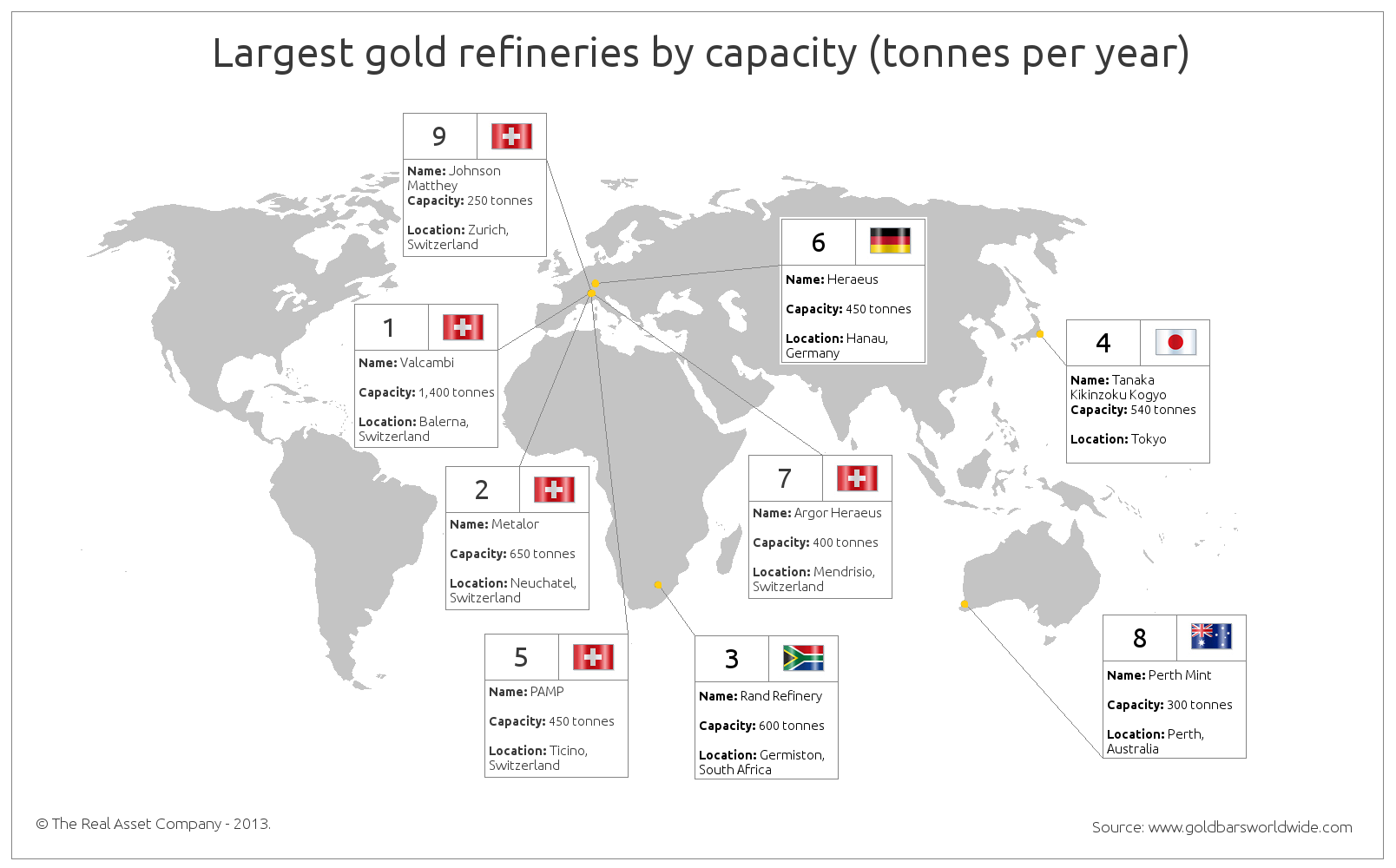

Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the  Largest Gold Refineries by Capacity (tonnes per year)

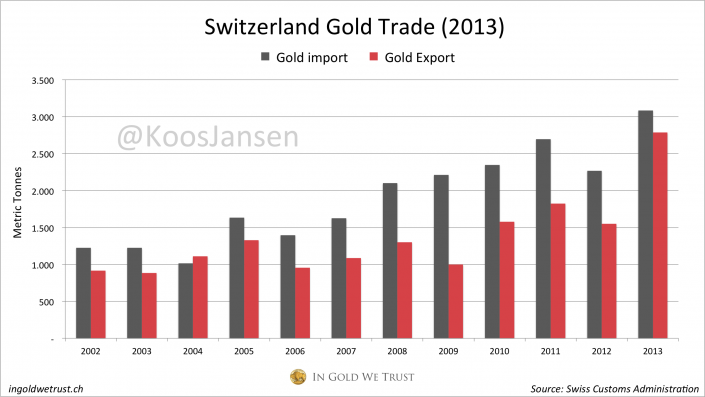

Largest Gold Refineries by Capacity (tonnes per year) Switzerland's Gold Trading (2013)

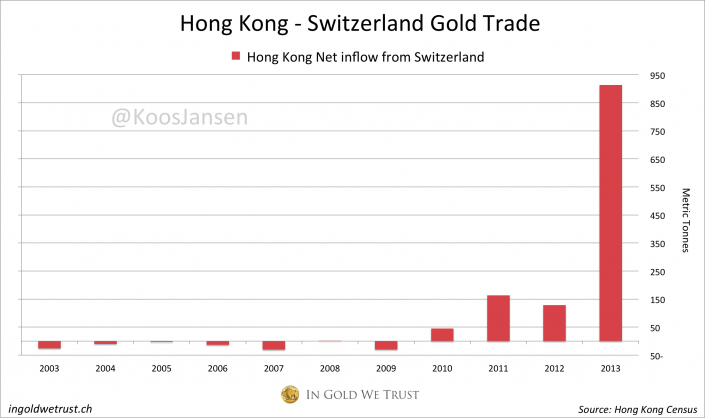

Switzerland's Gold Trading (2013) Gold Trading between Hong Kong and Switzerland

Gold Trading between Hong Kong and Switzerland Notes :

Notes :